North Vancouver Industrial Market Report Jan, 2024 - Mar, 2025

3/22/2025

North Vancouver Industrial Market Report Jan, 2024 - Mar, 2025

North Vancouver Industrial Market Report Jan, 2024 - Mar, 2025

As of early 2025, North Vancouver's industrial real estate market is experiencing notable developments, characterized by significant transactions, evolving market dynamics, and a cautiously optimistic outlook for the coming year.

Market Overview and Recent Transactions

In 2024, North Vancouver witnessed a landmark transaction that underscored its growing prominence in the industrial sector. The sale of 100 Forester Street, a 21.37-acre property, marked one of the largest industrial investment in the municipality's history. ERCO Worldwide sold the site to Hydrogen Technology & Energy Corporation (HTEC), which plans to develop the North Vancouver Clean Liquid Hydrogen Facility, aiming to bolster clean energy initiatives in the region. This transaction reflects a broader trend in Metro Vancouver, where industrial investment activity has remained robust. In 2024, the industrial sector reported nearly $1.6 billion in dollar volume transacted, a slight decrease of 9% year-over-year, indicating sustained investor confidence despite minor fluctuations.

In 2025, Wesbild sold 27.5-acre industrial site at 1371 McKeen Avenue, North Vancouver, located just south of West 1st Street and across the water from Stanley Park for $143M to Dream Industrial REIT (TSX: DIR.UN) and Singapore’s sovereign wealth fund GIC. Initially the property was acquired by Wesbild for $115,021,310 in July 2017.

The company planned to subdivide the northern 15 acres of the site into smaller lots to accommodate a variety of uses, including film production, a food commissary, e-commerce, craft brewing, and child care.

According to Wesbild, this vision aimed to create between 500 and 1,000 jobs on the northern portion of the property, a significant increase from the eight positions that were in place at the time.

Industrial Real Estate Trends and Policies

Several key trends are shaping North Vancouver's industrial real estate landscape:

Sustainability Initiatives: The development of HTEC's Clean Liquid Hydrogen Facility highlights a growing emphasis on sustainable and environmentally friendly industrial projects.

Rising Vacancy Rates: Metro Vancouver's industrial vacancy rate reached 3.1% in Q3 2024, the highest since 2015, indicating a shift towards a more balanced market.

Increased Sublease Availability: Sublease space has risen significantly, registering 1.9 million square feet, an eight-fold increase from Q2 2022, suggesting potential opportunities for tenants seeking flexible leasing options.

Tight Inventory: The industrial real estate market in North Vancouver continues to face a persistent supply shortage, restricting expansion opportunities for businesses. As a result, owner-users are increasingly looking beyond the area, seeking opportunities across the bridge to accommodate growth. With high demand and limited availability, well-located industrial properties are being swiftly acquired, highlighting the competitive nature of the market.

Opportunities

Strategic Acquisitions Amidst Rising Vacancy Rates

With Metro Vancouver’s industrial vacancy rate reaching 3.1% in late 2024, the highest level since 2015, businesses now have greater opportunities to secure industrial properties. While North Vancouver remains tight on supply, more leasing opportunities and sublease options are becoming available, allowing businesses to negotiate better terms and pricing.

Expansion Beyond North Vancouver

With industrial land availability in North Vancouver severely constrained, owner-users and investors are increasingly looking across the bridge to Burnaby, Richmond, and Surrey for growth. These markets offer larger industrial footprints, better transportation connectivity, and more modern facilities, making them attractive alternatives for businesses looking to expand.

Redevelopment Potential

Older industrial properties in North Vancouver present opportunities for redevelopment and intensification, particularly as demand shifts toward higher-density industrial solutions, such as multi-level warehouses. Investors and developers who can reposition underutilized assets stand to benefit from rising rental rates and increased demand for flexible industrial space.

Sustainability-Driven Investment

With growing pressure to meet ESG (Environmental, Social, and Governance) standards, industrial real estate in North Vancouver is increasingly focusing on green building certifications, energy-efficient designs, and sustainable operations. Businesses that align with low-carbon and clean energy initiatives, such as the HTEC Clean Liquid Hydrogen Facility, may attract government incentives, grants, and additional investment opportunities.

Demand for Specialized Industrial Space

Industries such as film production, biotech, and clean energy are fueling demand for highly specialized industrial properties in North Vancouver. Investors and developers who cater to these niche sectors—by creating purpose-built facilities—could see strong rental demand and long-term appreciation.

Challenges

Severe Land Constraints and High Competition

With limited available industrial land, businesses looking to expand within North Vancouver face an extremely competitive market. Well-positioned properties are quickly absorbed, often leaving businesses with few options for growth. This has led many owner-users to explore secondary markets, increasing industrial demand in Burnaby, Richmond, and even further out in Fraser Valley.

Rising Construction and Redevelopment Costs

For businesses considering redevelopment, high construction costs, rising material prices, and labor shortages continue to be major obstacles. The cost of industrial redevelopment in North Vancouver remains among the highest in Metro Vancouver, impacting feasibility for many potential projects.

Increasing Sublease Availability and Market Uncertainty

While high demand for industrial space continues, North Vancouver has seen an increase in sublease availability, with businesses either downsizing or relocating due to rising costs. This shift introduces greater market uncertainty, as businesses weigh expansion plans against potential economic slowdowns and changing lease rates.

Limited Infrastructure and Transportation Challenges

North Vancouver’s industrial sector relies heavily on efficient transportation networks, but congestion on key routes, such as the Ironworkers Memorial Bridge, poses ongoing logistical challenges. Without significant infrastructure improvements, businesses requiring high-volume transportation may find it difficult to maintain seamless operations in the area.

Regulatory and Zoning Limitations

As industrial land becomes increasingly scarce, zoning policies in North Vancouver remain a critical factor shaping the market. Stricter land-use regulations and environmental considerations may slow down new industrial developments, making it difficult for businesses to find or build new facilities within city limits.

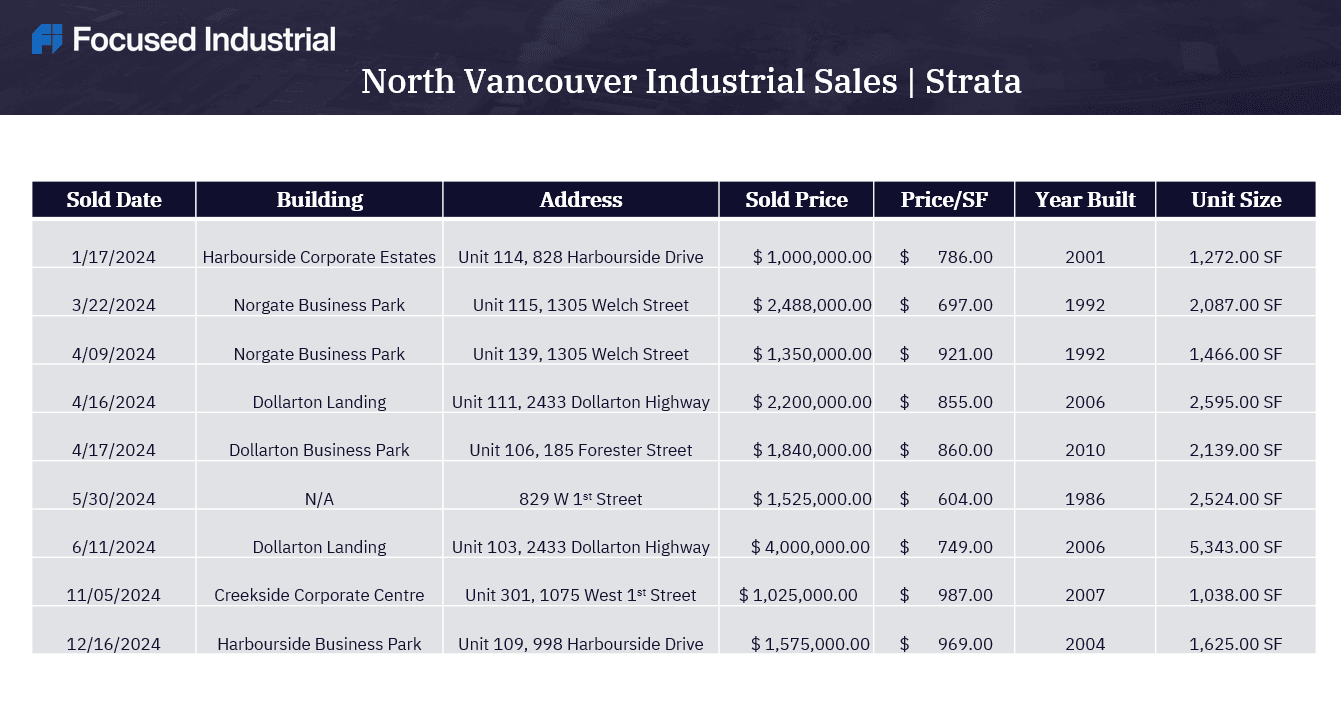

2024 Industrial Warehouse | Strata Sales - North Vancouver

Focused Industrial Group has compiled a summary of industrial strata and warehouse transactions in North Vancouver for 2024. If you own an industrial warehouse in the area, this report provides valuable insights into the approximate market value of your property.

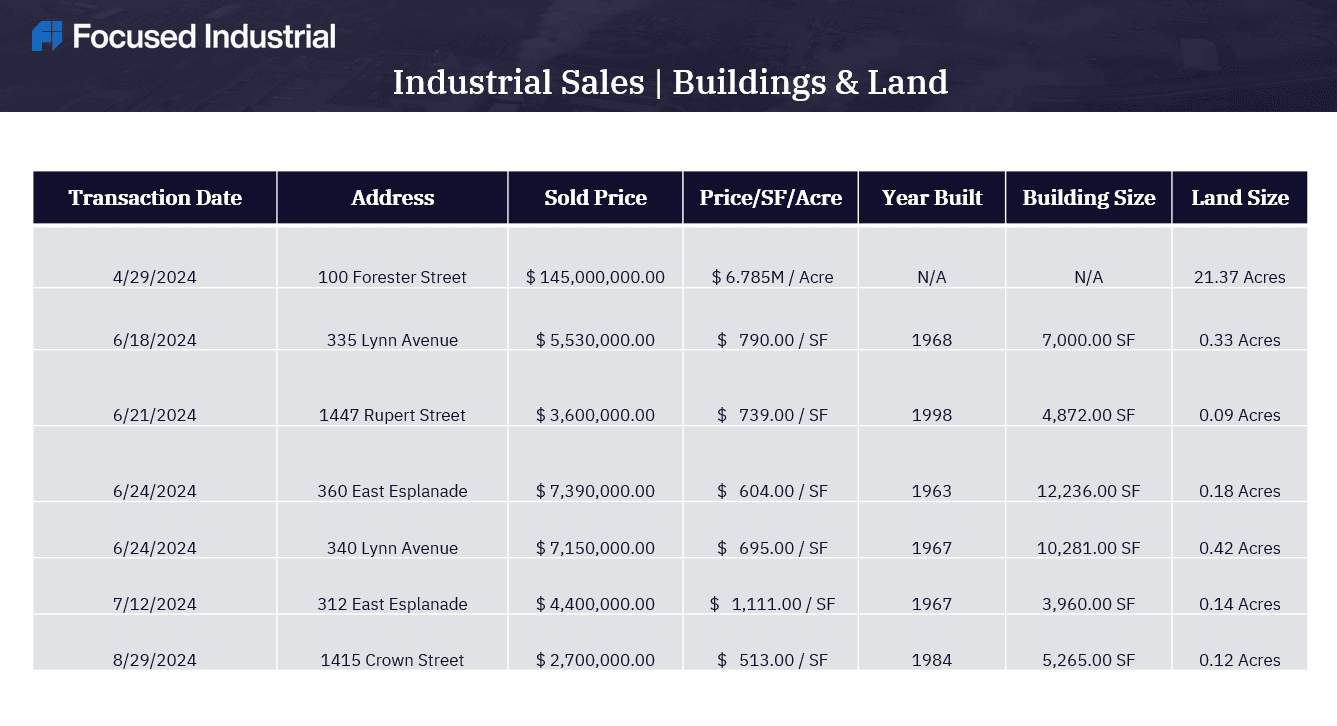

2024 Industrial Land | Freestanding Building Sales - North Vancouver

Market demand remains strong for freestanding properties and industrial land, whether for outdoor storage or redevelopment. In North Vancouver, industrial land prices are approximately $7 million per acre for larger parcels, with smaller parcels commanding significantly higher rates.

When valuing a commercial or industrial property, multiple factors must be considered to maximize returns and ensure no potential profit is overlooked. If you own a commercial property in North Vancouver or elsewhere in the Lower Mainland and would like an accurate, up-to-date market valuation, our team can assist you. Simply complete our Property Valuation Form, and we will provide a detailed assessment within 24 hours of your request.

Final Thoughts: What Lies Ahead?

North Vancouver’s industrial market is poised for continued demand and growth, but businesses and investors must navigate significant land shortages, rising costs, and regulatory hurdles. While challenges persist, opportunities exist for those who strategically position themselves in emerging markets, explore redevelopment, and invest in sustainable solutions.

With ongoing expansion in surrounding regions and the increasing focus on clean energy and specialized industries, North Vancouver’s industrial sector remains an attractive—but highly competitive—market for 2025 and beyond.

Browse available properties for sale in North Vancouver and surrounding municipalities here

In conclusion, having an accurate and current understanding of market activity, as well as your property's value—whether for lease or sale—is essential. Avoid costly mistakes and ensure you're making the most of your investment. Reach out to us today for a comprehensive valuation and maximize your returns. Don't leave money on the table—contact us now!