Delta Industrial Market Report Jan 1, 2024 - Dec 31, 2024

2/24/2025

Delta Industrial Market Report Jan1, 2024 - Dec 31, 2024

Delta Industrial Market Report Jan 1, 2024 - Dec 31, 2024

Delta, BC, remained a dominant player in Metro Vancouver’s industrial real estate sector in 2024, driven by strong demand, strategic location, and major investment activity. The city’s proximity to the Port of Vancouver, Highway 17, and the U.S. border continues to make it a highly sought-after market for logistics, warehousing, and manufacturing operations.

However, rising vacancy rates across Metro Vancouver, increasing sublease availability, and evolving economic conditions created new opportunities for tenants and investors while presenting challenges for developers. As vacancy rates climbed to 3.1%—the highest since 2015—Delta remained a prime market, maintaining strong absorption rates despite changing market dynamics.

Market Trends & Investment Outlook for 2025

Increasing Vacancy Rates & Sublease Space Availability

- Metro Vancouver’s industrial vacancy rate rose to 3.1% in 2024, the highest in nearly a decade.

- More sublease spaces are entering the market, providing businesses with more leasing options and negotiation power.

- Delta remains one of the most resilient submarkets, with ongoing demand from logistics, e-commerce, and port-related industries.

Land Constraints & Redevelopment Opportunities

- Delta has very little undeveloped industrial land, forcing developers to focus on redevelopment and intensification projects.

- Older industrial properties in Tilbury and Annacis Island are being repositioned for modern logistics and e-commerce operations.

- Expect more multi-level industrial developments in response to growing land shortages.

Infrastructure Upgrades Driving Industrial Expansion

- Delta continues to benefit from transportation and logistics improvements, including:

- Upgraded road networks in industrial zones (e.g., Parkwood Industrial Estates development).

- Port of Vancouver expansion projects increasing industrial activity.

- Proposed enhancements to Highway 17 and George Massey Tunnel upgrades, improving connectivity.

Sustainability & ESG Investment in Industrial Real Estate

- Developers and investors are prioritizing energy-efficient buildings, carbon-neutral logistics hubs, and green industrial parks.

- With Delta’s proximity to environmentally sensitive areas, expect more sustainable development regulations and initiatives in 2025.

Notable Transactions

Aritzia's New Distribution Facility: In March 2024, fashion retailer Aritzia announced plans for a state-of-the-art distribution center in Delta, developed by Beedie. The facility will feature 40-foot clear ceilings, 48 docks, 236 parking spaces, and amenities such as a gym and outdoor gathering spaces. Completion is slated for 2026.

Upcoming Developments & Pre-Sale Projects in 2025

- Parkwood Industrial Estates – A Key Project for Delta’s Future

- Location: 5224 88 St., Delta

- Details: This master-planned industrial project includes significant road and infrastructure improvements, designed to enhance transportation efficiency and accessibility for logistics and warehousing operations.

- Impact: The expansion of road networks and industrial infrastructure in Delta will further solidify the city’s position as a critical logistics hub in Metro Vancouver.

- Contact us for Built-To-Suite Opportunities For Lease

Read Delta Optimist Article about Industrial Development in Delta.

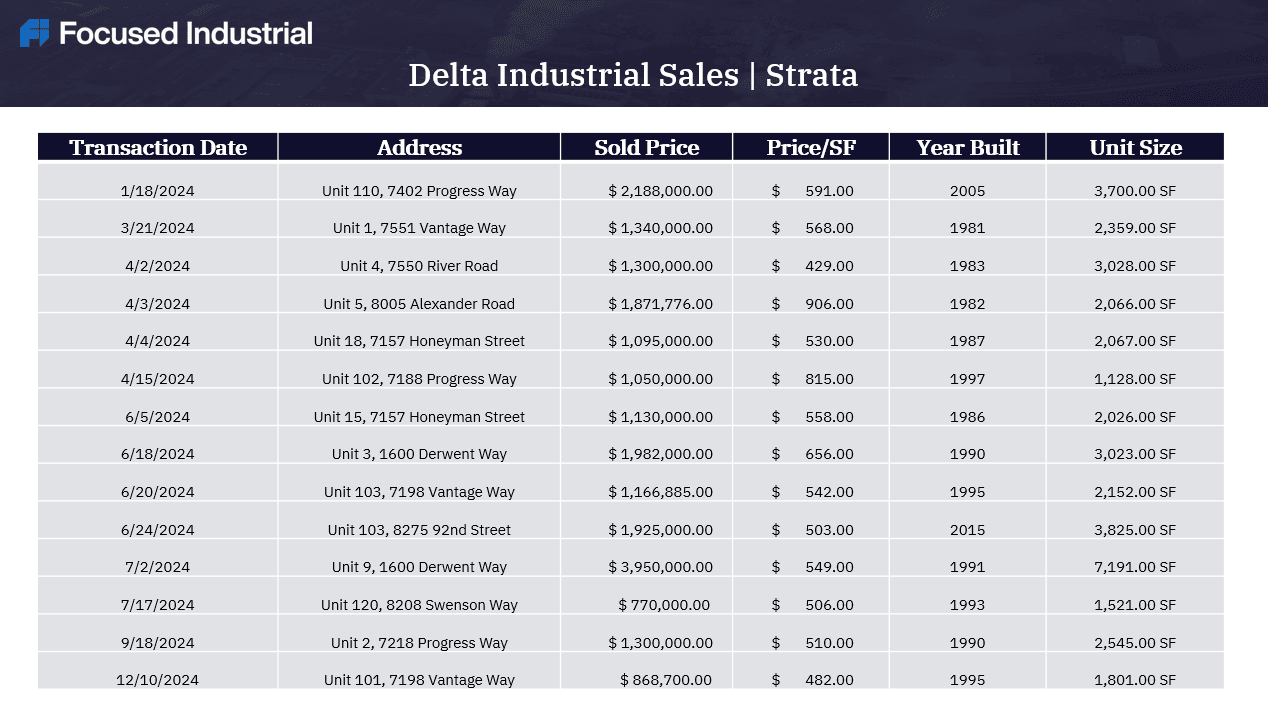

Delta Industrial Sales Summary | Warehouse Strata

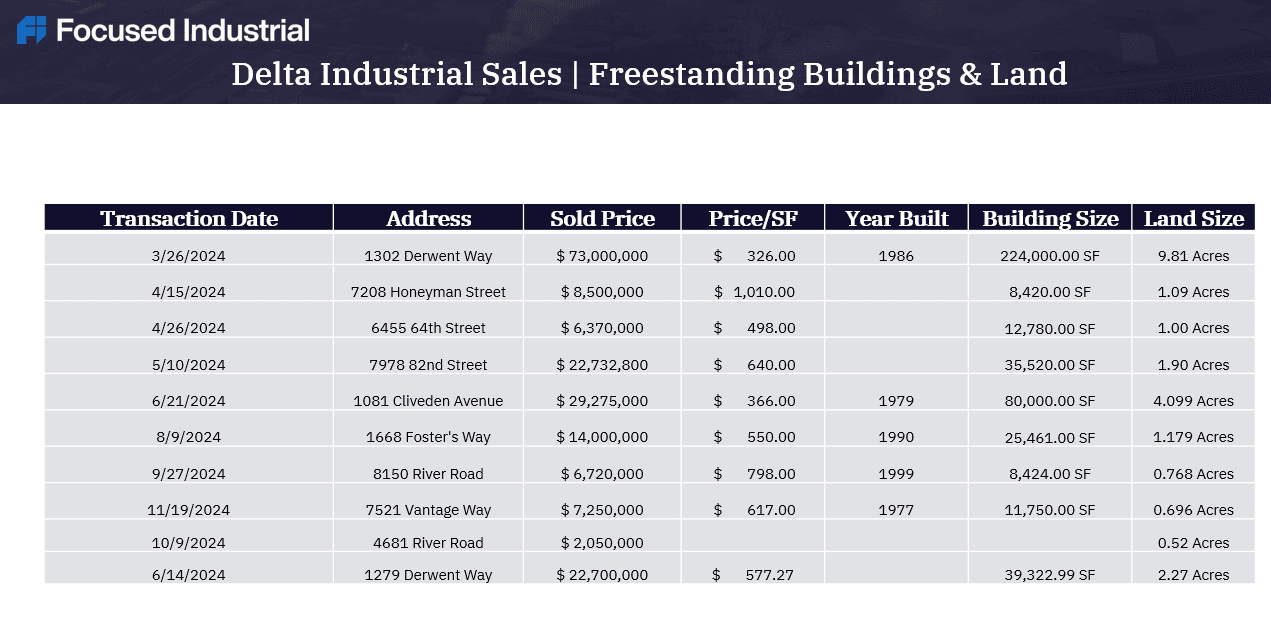

Industrial Freestanding Buildings Sold In 2024

Opportunities for Investors & Businesses in 2025

- Prime Buying Conditions – Rising vacancy rates create opportunities for investors to acquire industrial properties at more favorable terms.

- Strong Demand for Port-Adjacent Logistics Space – Delta’s access to the Port of Vancouver and transportation corridors will continue to attract logistics, e-commerce, and distribution firms.

- Redevelopment & Intensification Projects – With limited land supply, investors can capitalize on redeveloping older industrial sites into modern high-efficiency facilities.

- Infrastructure Improvements Enhancing Market Appeal – New roads, industrial parks, and logistics enhancements will strengthen Delta’s long-term growth potential.

Challenges & Market Risks to Watch in 2025

- Limited Land Supply & High Competition – With very few industrial land parcels available, competition for development sites remains fierce.

- Rising Construction Costs & Inflationary Pressures – Higher material and labor costs will continue to impact new industrial developments.

- Infrastructure Congestion & Transportation Bottlenecks – Traffic congestion on Highway 17, Highway 99, and the George Massey Tunnel could impact logistics efficiency.

- Evolving Government Policies & Regulatory Hurdles – Zoning changes, industrial land use restrictions, and sustainability mandates could affect future developments.

Final Outlook: What to Expect in 2025

Delta’s industrial real estate market is set for continued growth, driven by logistics demand, new infrastructure investments, and redevelopment opportunities. While land shortages, rising costs, and transportation challenges remain key risks, Delta is poised to remain a key player in Metro Vancouver’s industrial landscape.

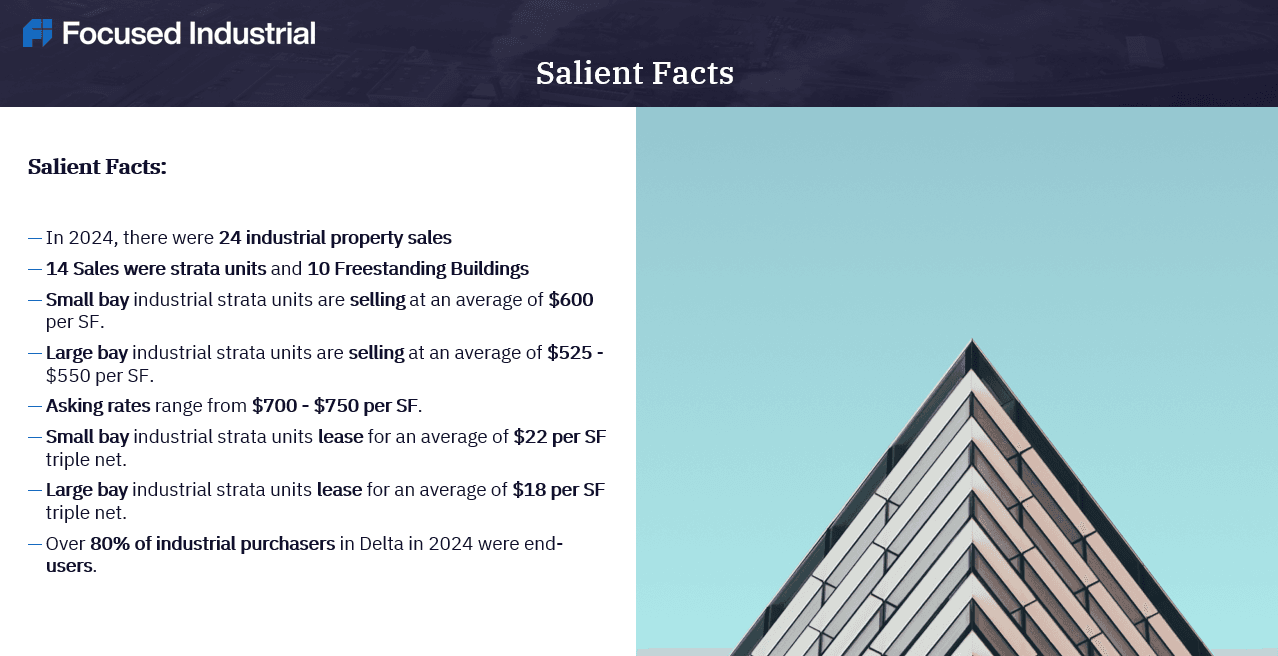

Salient Facts

Key 2025 Predictions

- Continued demand for modern logistics & warehousing space

- A more balanced market with strategic investment opportunities

- Ongoing infrastructure expansion improving industrial connectivity

- Increased focus on sustainability & ESG-compliant developments

Delta’s long-term fundamentals remain strong, making it a prime market for investors, developers, and businesses looking to secure industrial assets in Metro Vancouver. Click here to learn about Market We Serve.